Mental Wealth: 6 Reasons Why Working With a Financial Adviser Could Increase Your Happiness

The Research

According to a recent study conducted by Herbers & Company Research in 2021 *, research shows a strong correlation between your financial picture and your overall happiness. In our recent webinar, Mental Wealth: 6 Reasons Why Working With a Financial Adviser Could Increase Your Happiness, we examined how working with a financial adviser can increase an individual’s happiness.

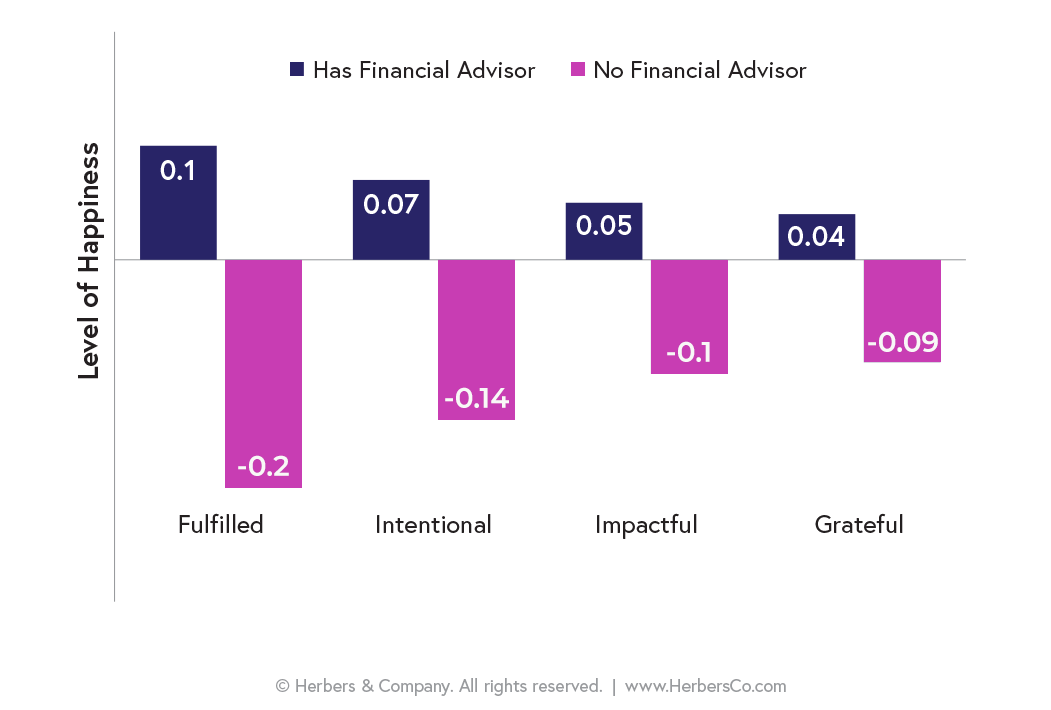

There are four elements of happiness within financial consumers: fulfillment, intention, impact and gratefulness that contribute to cumulative happiness. [See figure below]

The research found that all four areas were heightened among 66% of consumers who work with a financial adviser, versus 34% of those who do not. People who hire a financial adviser are statistically 3x happier than those who don’t.* This held true even when controlling for gender, age, income and asset levels. Most notably, the effect of working with a financial adviser on happiness is compounded for individuals with $1.2M or more in assets and becomes more important as asset levels rise. [Watch Clip To View Figure]

The study was also able to see non-financial benefits of having a financial planner, including higher relationship satisfaction and higher satisfaction with partner communication. By providing a safe place for couples to engage in conversation about money, advisers are deepening their relationships with their clients.

During the webinar, we also discussed the increase in stress and anxiety related to financial decisions, because generally people don’t prioritize talking about finances.

NCHS (CDC) monitors recent changes in mental health through their Household Pulse Survey, and every two weeks they update the percentage of adults who report symptoms of anxiety or depression. A positive outcome of COVID is that people are more willing to talk about the state of their mental health. Prior to the pandemic, 1 in 12 adults reported experiencing anxiety, with post pandemic rates showing 1 in 4 adults experiencing anxiety. The rates for depressive symptoms are similar with 1 in 17 prior to the pandemic, and now 1 in 5 reporting symptoms of depression.

With the increase in anxiety and depressive symptoms, we know people are likely wanting to find even more fulfillment, intention, impact and gratitude in their lives. Financial advisers can help bring the happiness advantage, by understanding their client’s stress, and giving them a safe space to talk about their finances.

Now that we’ve explored the connection between financial advice and happiness. Let’s dive into the six compelling reasons that showcase the positive impact a financial adviser can have on your life.

6 Reasons Why Working With a Financial Adviser Could Increase Your Happiness

1. Setting Financial Goals: Have a clear roadmap.

A financial adviser helps you create a well-thought out financial plan tailored to your goals and circumstances. By understanding your aspirations, values, and unique priorities, they can provide proper guidance, help you establish the right goals, and ensure you stay the course. Setting these goals provides a sense of purpose and direction, allowing you to focus your efforts on what truly matters to you. As you make progress towards your financial goals, you’ll experience a sense of accomplishment, which in turn boosts your overall happiness.

2. Minimizing Stress Levels: Communicate often and stay organized.

Managing finances can be complex and overwhelming. You can ease this burden by maintaining regular communication with your financial adviser, ensuring you stay organized. Financial advisers can help individuals navigate market noise by providing perspective, advising you on how to think through financial news stories, and answering questions to provide a better understanding of a current condition.

Making decisions can be hard even when picking a restaurant, so big decisions such as, when is the right time to retire, can be overwhelming. Open communication with your financial adviser allows them to understand your habits, likes and dislikes, giving you peace of mind and reducing financial anxieties.

3. Improving Decision-Making: Manage impulses and align decisions to long-term goals.

Maintaining an active and informed role in your financial planning, can aid in making complex financial choices. Collaborate with your financial adviser to properly manage impulse decisions, avoid temptations, and ensure choices are aligned to long-term plans.

It takes consistency and patience to grow wealth over a long period of time. Our brains are wired to pay more attention to emotional information, not just facts, so emotional decisions come into play, when finances are discussed. Financial advisers can help you make sound decisions based on facts, remind you of your roadmap and avoid impulse.

4. Receiving Tailored Solutions: Don’t listen to everyone! Make sure your plans support your unique goals and priorities.

Your financial situation is unique, and a financial adviser can provide personalized solutions that support your unique goals, risk tolerance, and priorities. Financial advice can come from many different places but it’s important to understand that every one situation is different. Some people want to travel, some people are nesters, some people are charity-inclined and others are not. Having open conversations with your financial adviser allows them to tailor personalized solutions to meet your individual goals.

5. Seeking Impactful Financial Communication: Talk to your financial adviser and receive trusted financial information to stay informed.

Financial advisers provide tailored guidance that can have a meaningful and positive effect on your financial well-being. They deliver financial information, recommendations, and strategies and to meet you where you are in your financial journey. Interacting with a financial adviser offers an opportunity to learn more about money management, investments and retirement planning, empowering you to take control of your finances and build confidence in your financial decisions.

A skilled adviser can actively listen to your concerns, provide clear explanations, and ensure you have a thorough understanding of your financial situation. This impactful financial communication fosters trust, confidence, and can ultimately contribute to your overall happiness.

6. Navigating Life Changes with Confidence: Scheduling regular reviews can help you stay on track, and ensure your financial strategy evolves with your circumstances.

Life is full of uncertainties and unexpected events, and major transitions can often come with financial implications. Whether it’s starting a family, changing careers, or planning for retirement, a financial adviser serves as a supportive partner during these times; a trusted source that can provide you with the information that you need, when you need it.

Did you know that every 7 minutes we experience a new stressor?

You’ve probably been hit with a few of them while reading this article. With the countless technology distractions and events that we experience everyday, being proactive, and having a plan in place ahead of time, will help you prepare for what’s to come.

In Summary

We have shared various ways a financial adviser can play a significant role in enhancing your happiness. In moments of stress, clients often turn to their advisers, who serve as guardians of their financial and emotional well-being. Watch our webinar on demand now and get a closer look at the research, real-life success stories, and actionable strategies to unlock your happiness through a strong financial partnership.

*Citations:

Herbers & Company’s: 2021 Consumer Financial Behavior Survey

CDC: Household Pulse Survey